President Donald Trump on Monday signaled his intention to expand government investments in American companies, following last week’s announcement that the U.S. had converted $11 billion in subsidies into a near-10% equity stake in Intel. The unprecedented move breaks from decades of U.S. economic policy, where federal ownership in private corporations was reserved for crises such as the 2008 financial bailout of automakers and banks.

Defending the Intel deal, Trump boasted on Truth Social that he would “make deals like that for our Country all day long,” highlighting Intel’s rising stock price as evidence of success. He added that similar “lucrative” arrangements could be offered to firms partnering with U.S. states, though he did not provide specifics. The Intel funds were originally tied to the CHIPS Act and earmarked for expanding U.S. semiconductor manufacturing, but the administration reframed them as an equity purchase.

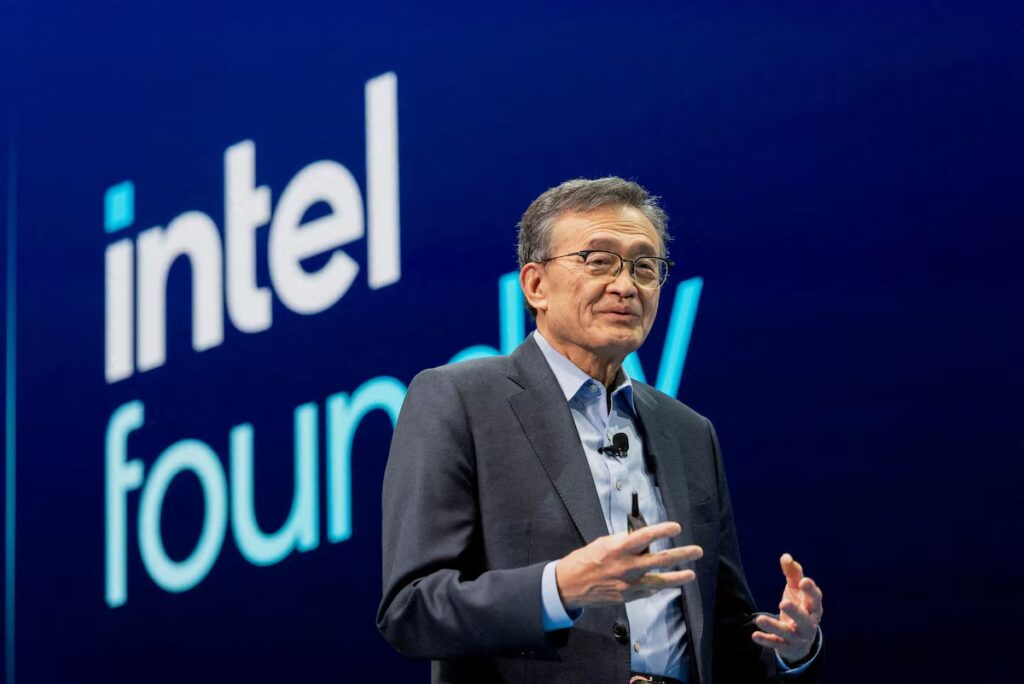

The bold strategy has drawn sharp criticism from business leaders and analysts who warn that Washington’s deeper involvement in corporate governance could stifle competitiveness and global sales. Intel itself raised red flags in a regulatory filing Monday, cautioning that government ownership may complicate international operations, restrict access to future grants, and trigger foreign regulatory hurdles. While Intel CEO Lip-Bu Tan welcomed the U.S. as a shareholder, he admitted, “I don’t need the grant.” Analysts also questioned whether government influence could eventually extend to steering customers toward Intel’s production capacity.