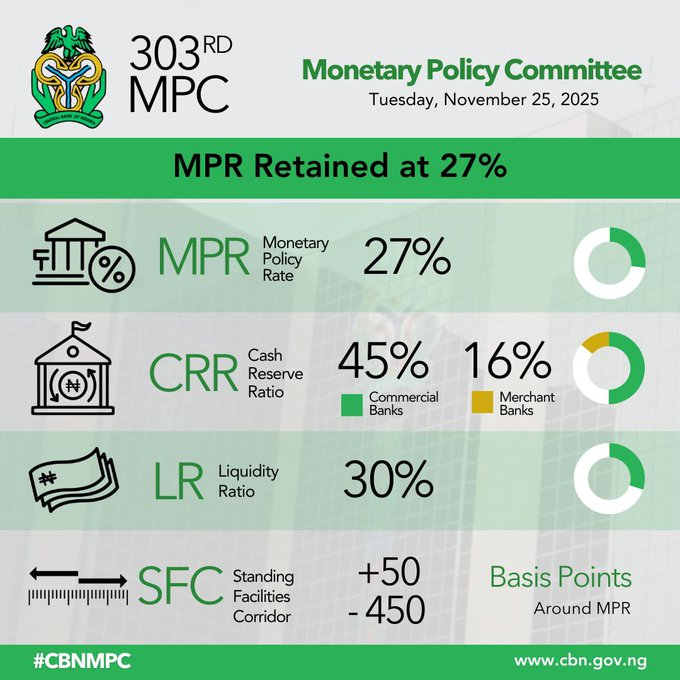

Nigeria’s Monetary Policy Committee has maintained a tight monetary stance after concluding its 303rd meeting, opting to retain major policy parameters in an effort to stabilise the economy amid persistent inflationary pressures. The committee kept the Monetary Policy Rate at 27 percent, signalling its continued focus on curbing price increases across key sectors of the economy.

In its resolution, the MPC also retained the Cash Reserve Ratio for commercial banks at 45 percent and maintained the CRR for merchant banks at 16 percent, while upholding the 75 percent CRR on non-TSA public sector deposits. The Liquidity Ratio was similarly maintained at 30 percent, reflecting the committee’s preference to sustain a firm grip on money supply as part of broader macroeconomic management efforts.

The Standing Facilities Corridor was adjusted to +50 and -450 basis points around the MPR, a move expected to influence short-term interest rates and guide market behaviour. As Nigeria continues to battle economic headwinds, will this consistent tightening be enough to ease inflation and restore investor confidence? Visit www.jocomms.com for more news