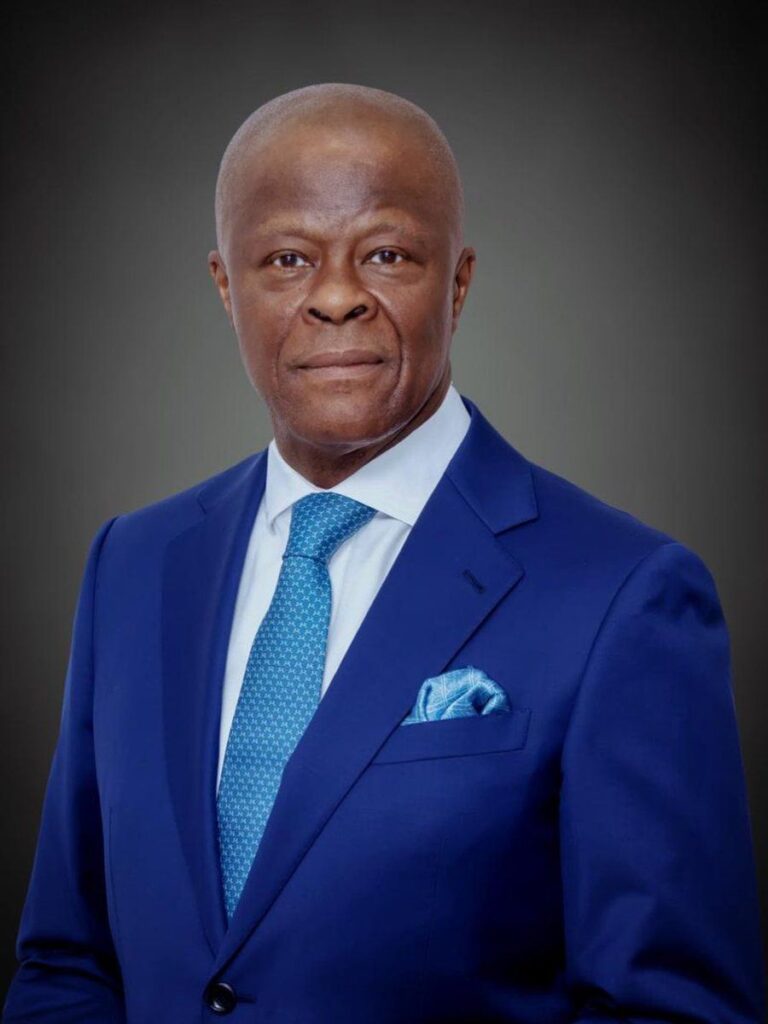

Nigeria’s Finance Minister and Coordinating Minister of the Economy, Wale Edun, has indicated that interest rate cuts could be considered as inflation continues to ease, raising hopes of relief for the country’s strained public finances.

Speaking during the Abu Dhabi Sustainability Week, Edun said sustained disinflation could give the Central Bank of Nigeria (CBN) room to relax its tight monetary policy. Nigeria’s high interest rates, introduced to curb inflation and stabilize the naira, have significantly increased borrowing costs.

Lower rates, Edun noted, would help reduce debt-servicing expenses, which currently consume a large portion of government revenue. Recent inflation data showing a downward trend has strengthened expectations of a gradual shift toward monetary easing.

While policymakers remain cautious, continued inflation moderation could pave the way for lower borrowing costs, improved fiscal flexibility, and increased economic activity. Visit www.jocomms.com for more news.