The U.S. dollar reached a two-year high on Thursday following the Federal Reserve’s cautious outlook on rate cuts in 2025. Meanwhile, the yen weakened to a one-month low after the Bank of Japan maintained its interest rate policy.

The BOJ’s decision to hold rates steady, as expected, highlighted divisions within the board, with one member advocating for higher borrowing costs. The yen fell 0.3% to 155.43 per dollar before settling at 155.24. Analysts believe the BOJ is balancing the yen’s depreciation with global market stability, while traders await Governor Kazuo Ueda’s remarks for clues on a potential rate hike early next year.

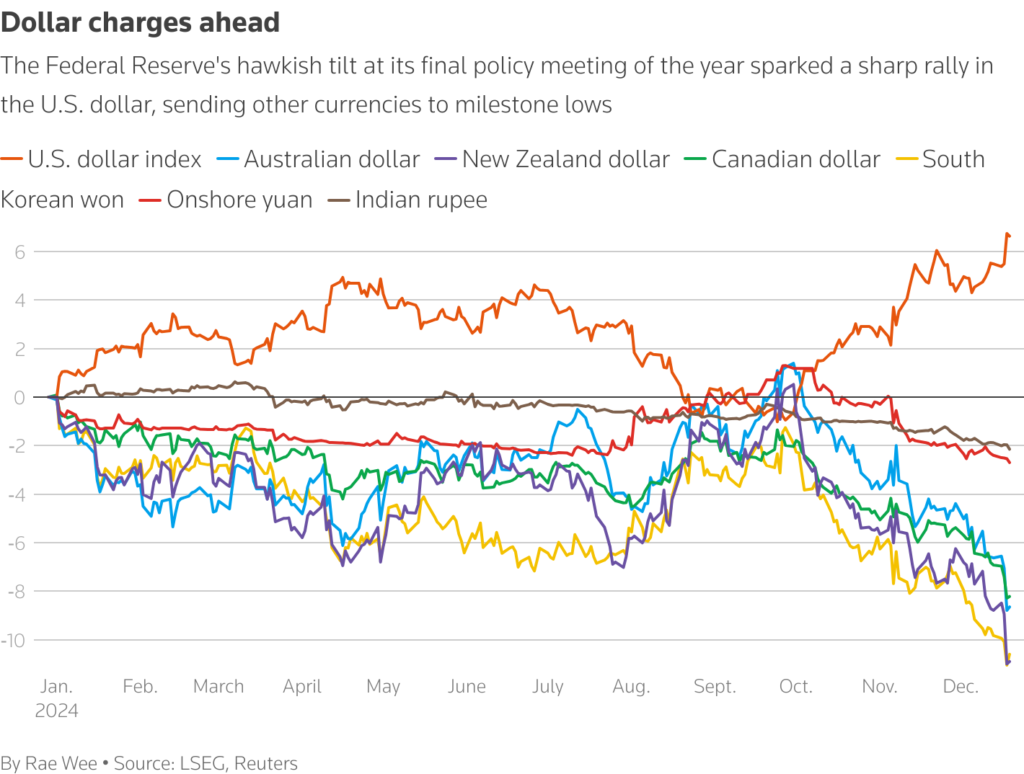

The dollar’s strength rippled across global markets, with currencies like the Swiss franc, Canadian dollar, and South Korean won hitting milestone lows. The Australian and New Zealand dollars also fell to multi-year lows, pressured by weak economic data.

Fed Chair Jerome Powell emphasized that further rate cuts hinge on progress in reducing inflation, a stance that has bolstered the dollar and dampened easing expectations. Markets now anticipate U.S. rates to remain on hold through the first half of 2025.

Sterling, the euro, and other currencies traded lower as global economic uncertainty persists. The dollar remains poised for continued strength, with central bank policies driving volatility across global currency markets.