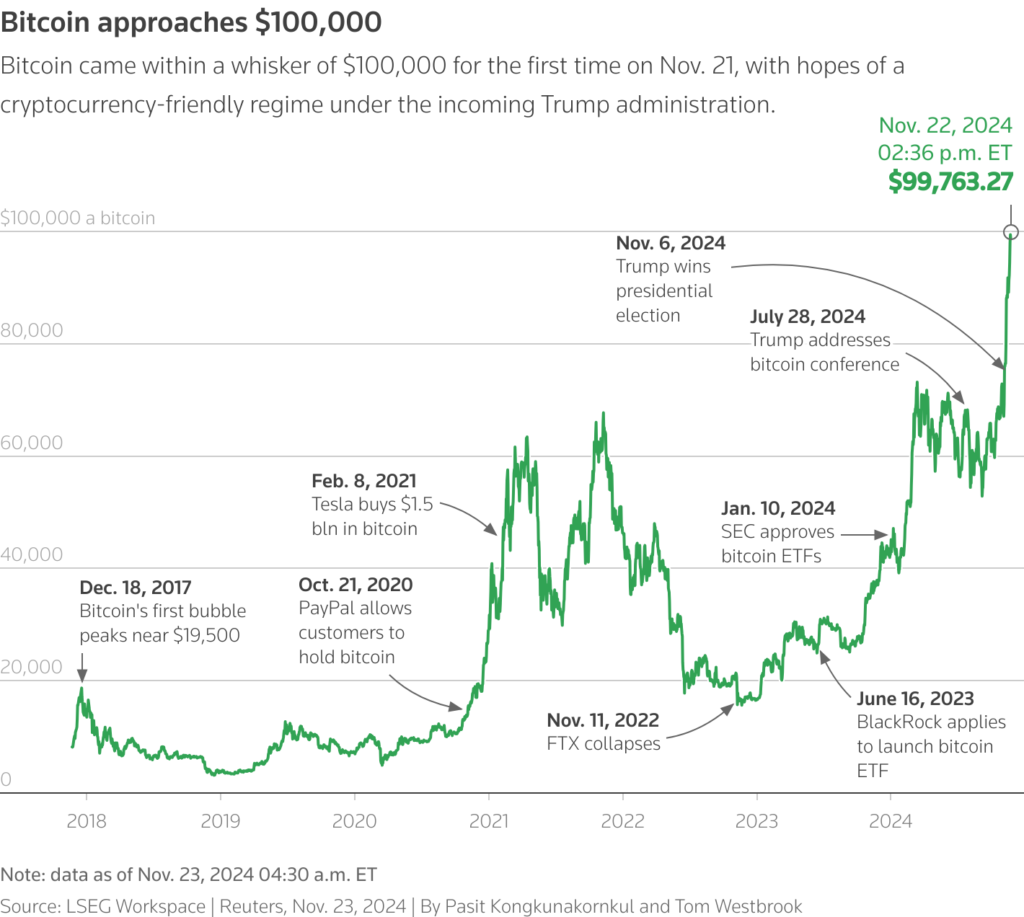

Bitcoin crossed the $100,000 milestone for the first time on Thursday, driven by optimism that the incoming Trump administration will foster a more favorable regulatory environment for cryptocurrencies. The cryptocurrency has more than doubled in value this year, with a 45% surge in the four weeks since Donald Trump’s presidential victory, which also ushered in several pro-crypto lawmakers into Congress.

As of 0240 GMT, bitcoin was trading at $100,027, having reached a peak of $100,277 earlier in the session. Mike Novogratz, CEO of Galaxy Digital, described the moment as a “paradigm shift,” attributing the rally to institutional adoption, technological advancements in digital assets, and a clearer regulatory outlook.

“Bitcoin crossing $100,000 is more than just a milestone; it’s a testament to shifting tides in finance, technology, and geopolitics,” said Justin D’Anethan, an independent crypto analyst based in Hong Kong.

President-elect Trump has embraced cryptocurrencies as a cornerstone of his economic strategy, vowing to position the United States as the “crypto capital of the planet.” During his campaign, he pledged to build a national bitcoin reserve and overhaul crypto regulation, signaling an end to stricter oversight under outgoing SEC Chair Gary Gensler, who announced his resignation effective in January.

Trump’s nominee for the SEC, Paul Atkins, has strong crypto ties as co-chair of the Token Alliance and a member of the Chamber of Digital Commerce. His leadership is expected to further catalyze the sector’s growth.

In addition to regulatory changes, Trump has reportedly tied his business interests to the crypto boom. His social media company, Trump Media and Technology Group, is in advanced talks to acquire Bakkt, a cryptocurrency trading firm, according to sources cited by the Financial Times. In September, Trump also unveiled a crypto-focused venture, World Liberty Financial, signaling his personal endorsement of the industry.

Billionaire Elon Musk, a Trump ally and prominent crypto supporter, has also contributed to the growing enthusiasm surrounding digital assets.

The approval of U.S.-listed bitcoin exchange-traded funds (ETFs) earlier this year has been another key driver of bitcoin’s rally. Previously blocked by the SEC due to investor protection concerns, ETFs have allowed institutional investors to gain exposure to bitcoin, bringing more than $4 billion into the market since November.

The surge has also lifted crypto-related stocks, with bitcoin miner MARA Holdings seeing a 65% rise in November.

However, critics remain cautious. The industry is still recovering from scandals like the collapse of FTX and concerns over its environmental impact. Additionally, market watchers warn of potential profit-taking now that bitcoin has broken the $100,000 barrier.

“Once we flush out those sell orders, this could go higher still, and very rapidly,” said Steven McClurg, founder of Canary Capital. He predicted bitcoin could hit $120,000 by Christmas, provided the current momentum continues.

The milestone represents a dramatic turnaround for bitcoin, which fell below $16,000 late last year. With institutional interest surging and regulatory clarity on the horizon, many believe this could mark the beginning of a new era for the cryptocurrency market.