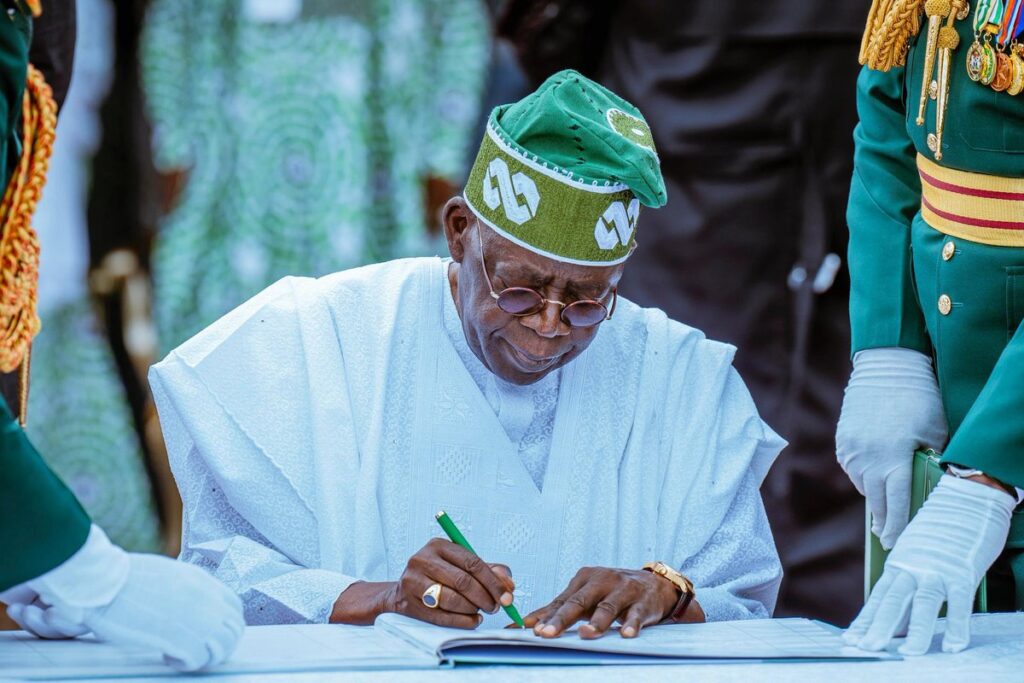

Since President Bola Tinubu transmitted four executive bills, collectively known as the #TaxReformBills, to the National Assembly, the debate around them has sparked controversy. Many Nigerians remain confused about their implications, especially concerning personal finances. Here’s a simplified breakdown to help clarify these bills, their contents, and potential impact.

Overview of the Four Tax Reform Bills

The reform aims to streamline Nigeria’s taxation system by consolidating laws and administrative frameworks under four key bills:

1. Nigeria Tax Bill

2. Nigeria Tax Administration Bill

3. Nigeria Revenue Service Establishment Bill

4. Joint Revenue Board Establishment Bill

These bills are designed to modernize tax laws, improve efficiency, and reduce the tax burden on low-income earners and small businesses while boosting national revenue.

Key Highlights of the Nigeria Tax Bill

This bill serves as a comprehensive guide to taxes imposed on individuals and businesses, merging and repealing 11 existing laws. Major provisions include:

• Exemptions for Low-Income Earners:

Individuals earning ₦800,000 or less annually will no longer pay income tax. This is a significant change from the current law, which charges ₦84,000 on such earnings.

• Higher Threshold for Top Tax Rates:

The 25% personal income tax rate will only apply to those earning above ₦50 million, compared to ₦3.2 million under current laws.

• Support for Small Businesses:

Small businesses with an annual turnover of ₦50 million or less will be exempt from income tax, benefiting about 90% of businesses.

• Reduced Corporate Taxes:

The company income tax rate will drop from 30% to 25% by 2026, while minimum income tax on non-profitable firms will be eliminated.

• Simplified Development Levies:

Taxes such as education, NITDA, and NASENI levies will be combined into a single 2% development levy dedicated to funding student loans.

• VAT Adjustments:

Basic goods like food, medicine, and electricity will remain VAT-exempt, but the VAT rate will gradually increase to 15% by 2030.

Key Highlights of the Nigeria Tax Administration Bill

This bill focuses on improving how taxes are collected and managed, with notable provisions such as:

1. Targeting Wealthy Tax Evaders:

Financial institutions must report individuals with monthly transactions exceeding ₦25 million and companies exceeding ₦100 million.

2. Currency Flexibility in Payments:

Taxes assessed in foreign currencies can now be paid in Naira or the foreign currency, promoting exchange rate stability.

3. Automation of Tax Processes:

Technology will be deployed to enhance tax collection, especially for digital businesses like social media and streaming platforms.

4. Fair Revenue Sharing:

A new VAT derivation model ensures states get 60% of VAT revenues based on consumption location rather than company headquarters.

Other Bills and Their Implications

• Nigeria Revenue Service Establishment Bill:

Rebrands the Federal Inland Revenue Service (FIRS) as the Nigeria Revenue Service (NRS) to emphasize its national role and consolidates tax collection functions from other agencies.

• Joint Revenue Board Establishment Bill:

Establishes the Joint Revenue Board, Tax Appeal Tribunal, and Tax Ombudsman to harmonize taxes, resolve disputes, and protect taxpayer rights.

Why These Reforms Matter

These bills aim to overhaul Nigeria’s outdated tax system to ensure fairness, transparency, and efficiency. Key beneficiaries include:

• Low-Income Earners: Exempt from taxes on basic earnings and essential goods.

• Small Businesses: Enjoy expanded definitions and exemptions from income tax.

• State Governments: Receive a larger share of VAT revenue, distributed more equitably.

While some critics argue the reforms may impose additional burdens through higher VAT rates in the future, the government emphasizes that these changes are pro-poor, pro-growth, and designed to simplify the tax system for all Nigerians.

For more clarity and engagement, it’s essential for every Nigerian to familiarize themselves with these bills and their potential to transform tax administration in the country.

Dada, Special Assistant to President Tinubu on Digital Media.