The Central Bank of Nigeria (CBN) has announced a review of Automated Teller Machine (ATM) transaction fees, introducing new charges for withdrawals at different ATM locations across the country.

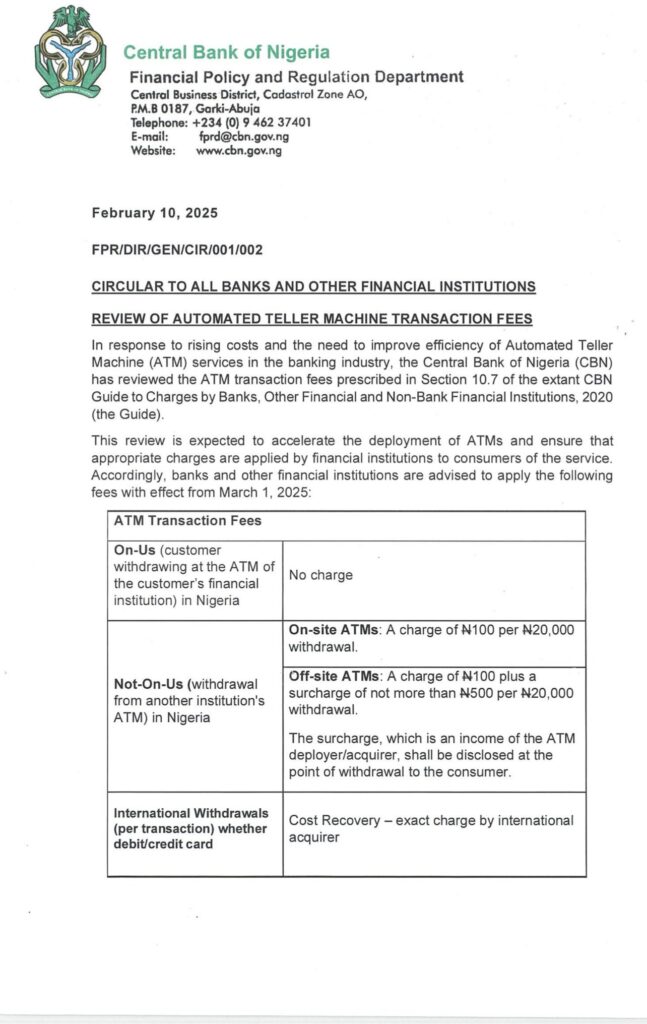

According to a circular issued by the Financial Policy and Regulation Department, the changes will take effect from March 1, 2025. Under the new directive, withdrawals at a customer’s own bank’s ATM (On-Us transactions) will remain free of charge. However, withdrawals from another bank’s ATM (Not-On-Us transactions) will now attract a fee of ₦100 per ₦20,000 withdrawal at on-site ATMs. For off-site ATMs, an additional surcharge of up to ₦500 per ₦20,000 withdrawal will apply.

For international withdrawals using debit or credit cards, customers will be charged the exact amount set by the international acquirer under a cost recovery policy.

Additionally, the CBN has scrapped the three free monthly withdrawals previously allowed for Remote-On-Us transactions (withdrawals by a customer using another bank’s ATM). This means customers will now pay for every withdrawal made at another institution’s ATM.

The review is aimed at improving the efficiency of ATM services in the country and encouraging banks to deploy more ATMs to enhance accessibility. The CBN also directed that the surcharges on off-site ATMs, which are the income of the ATM deployer/acquirer, must be disclosed to consumers at the point of withdrawal.

The move has sparked mixed reactions from Nigerians, with some expressing concerns about the potential financial burden on customers, especially those in areas with limited banking infrastructure. Others believe it will encourage more cashless transactions and reduce congestion at ATMs.

With the implementation date approaching, banks and financial institutions have been advised to update their systems and inform customers accordingly.