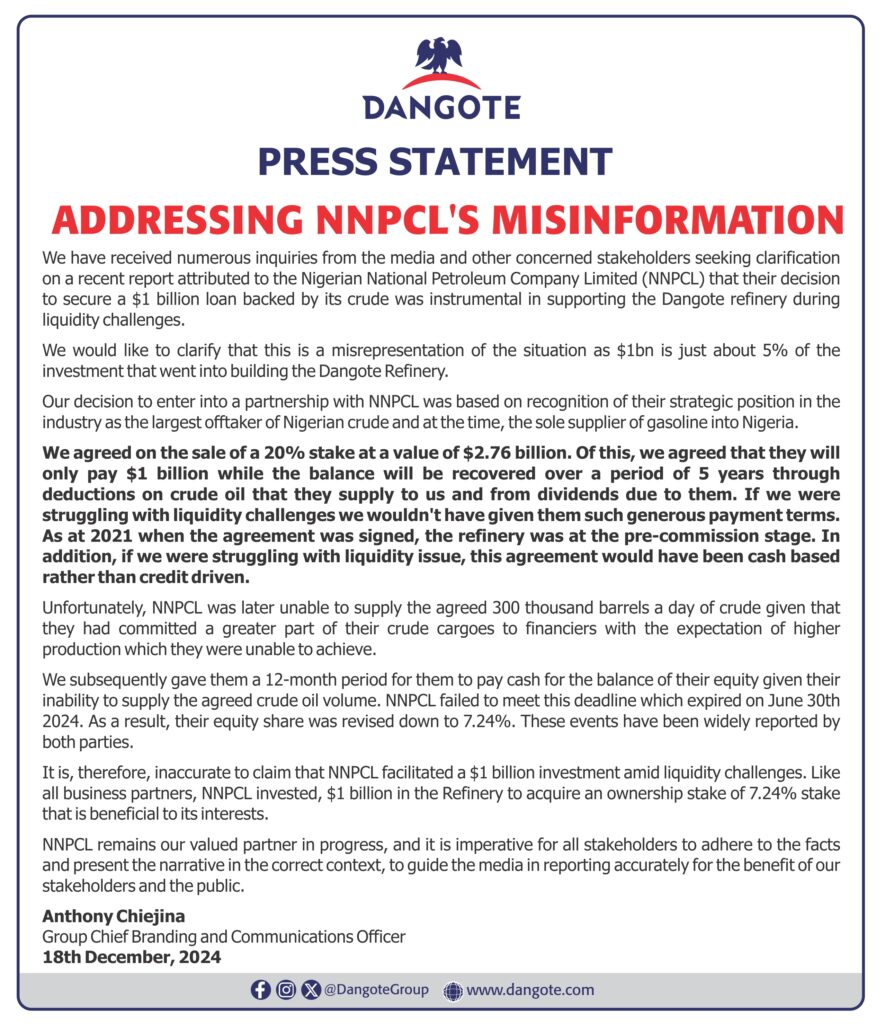

The management of Dangote Refinery has clarified reports circulating about a $1 billion loan from the Nigerian National Petroleum Company Limited (NNPCL), addressing inquiries from the media and stakeholders. The refinery stated unequivocally that claims linking the loan to addressing liquidity challenges are misleading and do not represent the true context of the situation.

In a statement signed by Anthony Chiejina, Group Chief Branding and Communications Officer, Dangote Refinery explained that the $1 billion investment from NNPCL accounted for only 5% of the total cost of constructing the refinery. The partnership with NNPCL was established based on their strategic role in the industry as the largest off-taker of Nigerian crude and the sole gasoline supplier in the country at the time.

The agreement between the two parties involved the sale of a 20% equity stake in the refinery to NNPCL, valued at $2.76 billion. Out of this amount, NNPCL committed to paying $1 billion upfront, while the remaining balance was structured for recovery over five years through deductions on crude oil supplies and dividends.

“Had the refinery faced liquidity challenges, such a credit-driven arrangement would not have been possible,” Chiejina noted, emphasizing that the deal was signed in 2021 when the refinery was still at its pre-commission stage.

However, NNPCL later faced challenges in meeting its obligation to supply the agreed 300,000 barrels of crude per day. According to Dangote Refinery, NNPCL had previously committed most of its crude cargoes to other financiers based on expectations of increased production, which did not materialize.

Due to these challenges, Dangote Refinery granted NNPCL a 12-month window to pay the outstanding equity balance in cash. This deadline expired on June 30, 2024, without payment. Consequently, NNPCL’s equity share in the refinery was revised from 20% to 7.24%.

“It is inaccurate to claim that NNPCL facilitated a $1 billion investment to address liquidity challenges,” the statement added. “The $1 billion was part of their acquisition of a 7.24% stake in the refinery, structured in a manner beneficial to their interests.”

Despite the challenges, Dangote Refinery reiterated its commitment to maintaining a productive partnership with NNPCL, which it described as a valued partner in progress. The company urged stakeholders and the media to adhere to factual reporting to ensure the public receives accurate information.

The statement underscores the importance of clarity in the narrative surrounding the partnership, particularly given the strategic role of both parties in Nigeria’s energy landscape.