The U.S. dollar was poised for its best week in over a month on Friday, reaching near one-year highs as markets adjusted to fewer expected Federal Reserve rate cuts and speculated on inflationary impacts from Donald Trump’s incoming administration. The dollar index was last at 106.88, heading for a weekly gain of 1.8%, its strongest performance since September.

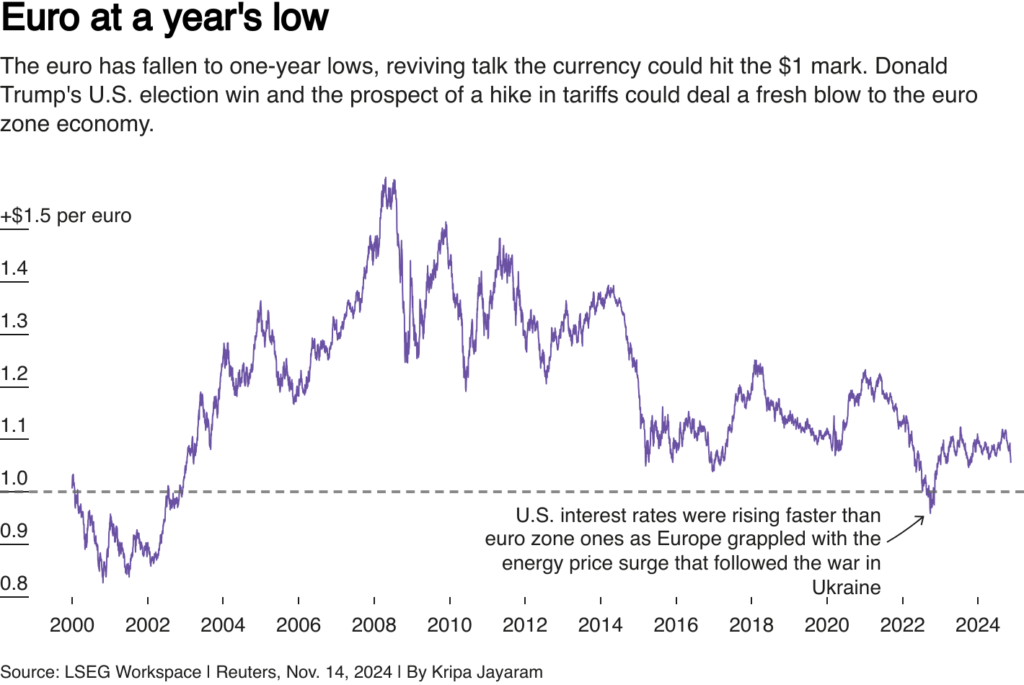

In contrast, the euro was on track for its worst week in seven months, dropping 1.75% to $1.0530, near the one-year low it touched earlier this week. Meanwhile, the British pound also lost ground, trading at $1.2666 and set for a 2% weekly decline, marking its steepest drop since January 2023.

This surge in the dollar came after Federal Reserve Chair Jerome Powell stated on Thursday that there was no need to rush interest rate cuts, citing steady economic growth, strong employment figures, and persistent inflation as reasons for a cautious approach. As a result, traders scaled back their expectations for near-term rate cuts, with Fed funds futures now pricing in only 71 basis points of easing by the end of 2025. Expectations for a December rate cut dropped significantly, with the CME FedWatch tool showing a 48.3% probability, down from 82.5% the day prior.

“Markets took Powell’s comments at face value and scaled back expectations for FOMC rate cuts,” said Carol Kong, a currency strategist at Commonwealth Bank of Australia. “We still think a 25 basis point cut in December is likely, but Powell’s remarks highlighted the resilience of the U.S. economy.”

The anticipation of President-elect Trump’s policy platform also fueled dollar optimism. Investors expect that policies like higher trade tariffs and tighter immigration could stoke inflation, potentially delaying the Fed’s easing timeline. Additional expectations of increased deficit spending under Trump have driven U.S. Treasury yields higher, adding further support for the dollar.

In the currency markets, the Japanese yen continued to weaken, down 0.2% at 156.57 per dollar and headed for a 2.5% weekly decline. The yen has lost 11% since its peak in September and is now trading at levels that previously triggered intervention from Japanese authorities.

With the dollar’s rally, global markets are facing renewed volatility as investors brace for Trump’s policy impacts and recalibrate their expectations for the Fed’s rate strategy.