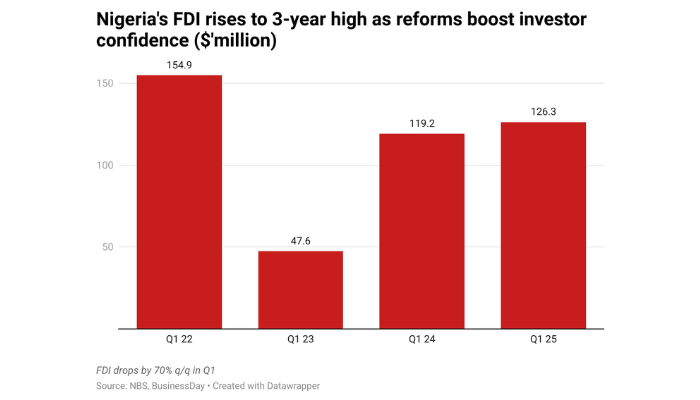

Foreign Direct Investment (FDI) into Nigeria has surged to its highest level in three years, driven by the policy reforms under President Bola Ahmed Tinubu’s administration, sparking optimism among investors about the country’s economic future.

FDI for the first quarter of 2025 reached $126.29 million, marking a 5.97% increase from the same period in 2024, when the country saw inflows of $119.2 million. The latest figures from the National Bureau of Statistics (NBS) highlight the positive impact of government policies aimed at enhancing Nigeria’s investment climate.

While the year-on-year increase is noteworthy, the report also reveals a sharp 70% quarter-on-quarter decline in FDI. Analysts point out that despite the dip in quarterly investment, the rise in FDI on an annual basis suggests that Nigeria’s long-term prospects remain appealing to investors, thanks to Tinubu’s reform agenda.

“These reforms are reshaping the country’s investment landscape,” said an analyst from a leading economic research firm. “Nigeria’s commitment to improving the ease of doing business, combating corruption, and stabilizing the currency is gaining traction among foreign investors.”

Though some challenges remain, including the volatile exchange rate and infrastructural deficits, the government’s continued focus on economic diversification and investor-friendly policies has laid a strong foundation for sustainable growth.

Investment in Key Sectors

The sectors most likely to benefit from this renewed foreign interest include agriculture, technology, and manufacturing, areas where policy reforms have been particularly focused. The livestock sector, in particular, has seen a significant influx of investment, driven by the government’s initiatives to boost agribusiness in the country.

“Tinubu’s focus on diversifying Nigeria’s economy away from oil dependence is already starting to pay dividends,” said another economic expert. “The growth in non-oil sectors is attracting both foreign capital and expertise, which will be crucial in reducing the country’s reliance on crude oil exports.”

However, experts remain cautious about the need for continued policy stability and infrastructure improvement to fully capitalize on the potential of these reforms.

Challenges Ahead for FDI

Despite the positive growth in FDI, challenges such as security concerns, high operational costs, and a complex regulatory environment continue to pose risks to Nigeria’s investment climate. The government has acknowledged these hurdles and is working on further reforms to make Nigeria a more attractive destination for global investors.

In conclusion, while the quarterly drop in FDI raises some concerns, the overall increase in foreign investment indicates growing confidence in Nigeria’s economic transformation under President Tinubu’s leadership. The coming months will be crucial in determining whether these reforms can sustain momentum and drive even greater investment inflows.