In a dramatic shift in the tech industry, semiconductor giants Nvidia and AMD have entered into a landmark deal that will see them pay 15% of their Chinese revenues to the United States government in exchange for securing export licenses to China.

This unprecedented agreement comes in the wake of a series of US export controls imposed on powerful chips used in artificial intelligence (AI) applications. These restrictions, primarily driven by national security concerns, had previously prohibited the sale of high-performance chips to China.

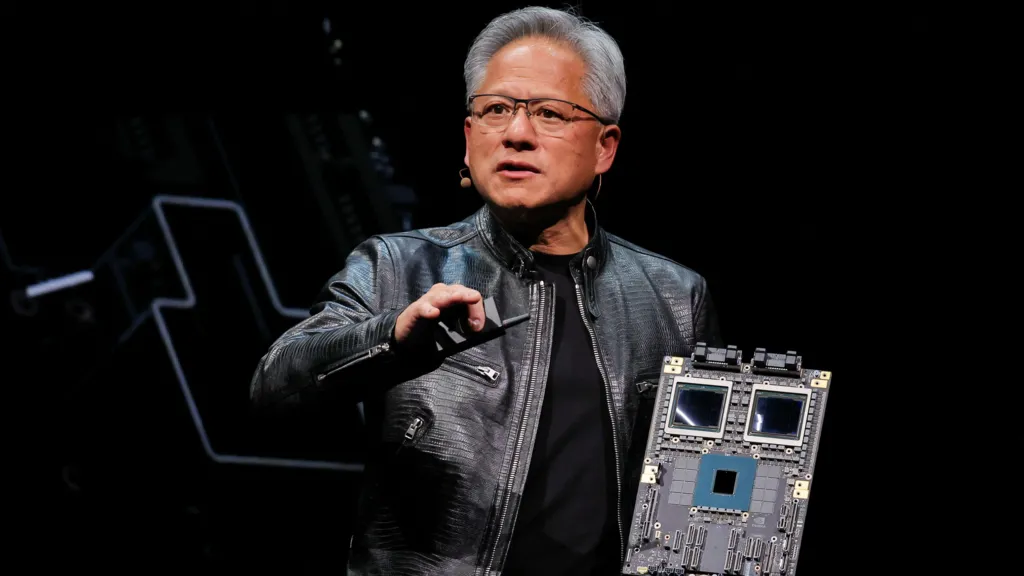

The H20 chip from Nvidia, specifically designed for the Chinese market, faced a significant ban under the Trump administration in April, following tighter export restrictions introduced by the Biden administration in 2023. Nvidia has been lobbying the US government for months to resume its sales to China, and, as part of the deal, it will pay 15% of its H20 chip revenues generated in China to the US government.

“We follow the rules the US government sets for our participation in worldwide markets,” said Jensen Huang, CEO of Nvidia. “While we haven’t shipped H20 to China for months, we hope export control rules will let America compete in China and worldwide.”

Meanwhile, AMD, which has also been caught in the crosshairs of the US-China tech trade war, will be required to pay 15% of its revenue from its MI308 chip sales in China to the Trump administration.

The terms of the deal were first reported by the Financial Times, marking a significant turn in the ongoing trade tensions between the US and China. These payments to the US government are intended to mitigate concerns over the potential use of advanced chips, such as the H20, in military applications. Security experts have raised alarms that AI chips like the H20 could fuel China’s autonomous weapon systems and surveillance platforms.

“The 15% payment does not eliminate the national security issue,” said Deborah Elms, head of trade policy at the Hinrich Foundation. “If you have a national security problem, you have a national security problem.”

Nvidia’s deal comes after a group of 20 security experts sent a letter to US Commerce Secretary Howard Lutnick warning that while most buyers of Nvidia’s H20 chip are civilian companies in China, the chips may ultimately be used by military entities. “Chips optimized for AI inference will not simply power consumer products or factory logistics; they will enable autonomous weapons systems, intelligence surveillance platforms, and rapid advances in battlefield decision-making,” the letter stated.

Amid the ongoing US-China tensions, this deal signals a potential thawing of the trade standoff. In recent months, there have been signs of easing trade relations between the two superpowers. China has relaxed its controls on rare earth exports, while the US has lifted some restrictions on chip design software firms operating in China.

In a broader context, this arrangement reflects the escalating financial and strategic pressures that tech vendors face as they navigate the increasingly fraught US-China trade landscape. “This agreement underscores the high cost of market access amid escalating tech trade tensions, creating substantial financial pressure and strategic uncertainty for tech vendors,” said Charlie Dai, vice president at Forrester Research.

The arrangement also coincides with a broader push by the Trump administration to bring more manufacturing jobs back to the US. Apple recently announced an additional $100 billion investment in the US, and memory chip maker Micron Technology pledged $200 billion in investments, including the construction of a new facility in Idaho.

Meanwhile, the US government’s focus on China’s technological advances continues to shape the debate over intellectual property, military applications of AI, and international competitiveness. As the US and China continue to jockey for dominance in AI technology, Nvidia and AMD’s agreement highlights the high stakes of global tech trade.

The return of chip sales to China could further shift the delicate balance of international tech power, while also providing a much-needed boost to US firms looking to tap into the lucrative Chinese market.

The implications of this deal will unfold in the coming months, as both countries continue to navigate their complex and competitive relationship in the high-tech sector.