The Debt Management Office (DMO) has opened subscription for the July 2025 issuance of Federal Government of Nigeria (FGN) savings bonds, offering competitive interest rates of up to 16.762% per annum. The subscription window, which began on July 7 and runs until July 11, provides both retail and institutional investors with a secure, government-backed investment option.

Investors can choose between two tenor options: a 2-year bond maturing on July 16 2027 with a 15.762% annual yield and a 3-year bond maturing on July 16 2028 with a 16.762% yield. Each bond unit is priced at ₦1,000 with a minimum subscription of ₦5,000 and a maximum of ₦50 million. Interest payments will be made quarterly on January 16, April 16, July 16 and October 16.

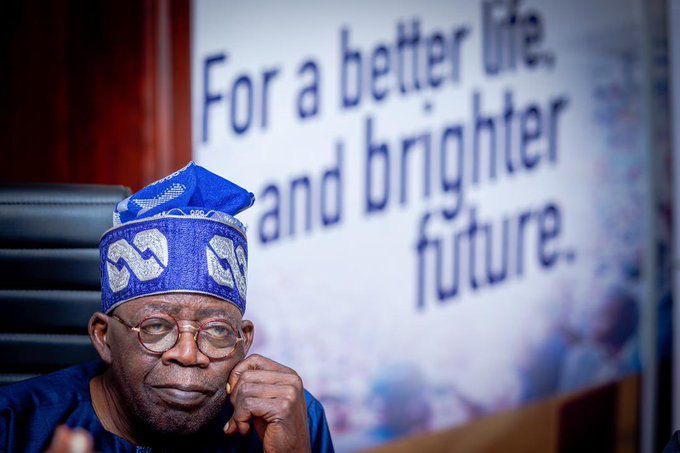

Market analysts see these bonds as especially appealing in the current macroeconomic context given the Central Bank of Nigeria’s maintained monetary policy rate of 27.5% and the desire of investors particularly risk-averse retail savers and retirees for stable, inflation-beating returns. The offering underscores the Tinubu administration’s strategy to deepen domestic capital markets and boost financial inclusion through government-backed financial instruments.

Interested Nigerians are encouraged to subscribe through accredited stockbrokers or via the DMO platform before the July 11 deadline. With previous subscriptions reaching ₦4.01 billion in June, the latest round reflects robust investor confidence in government securities and highlights the presidency’s efforts to mobilize domestic funding for Nigeria’s development agenda.